The high percentage win rate of this strategy is offset by occasional large losses, and use of any kind of stop-loss will harm performance. This particular trade is exited for a small loss.Į Note that no stop-loss has been placed and that trade draw-downs can be significant, as at point E. This will need to be adjusted on a daily basis after the close. A market buy order is entered at the close to establish a long position.ĭ A ‘Sell Limit’ order is placed at the profit target at the 10-period SMA. The daily price bar has also closed below a 10-period SMA. Recognition of a simple chart pattern is also required: trades will be entered only when the market has made its highest high in three days (for short positions), or its lowest low in three days (for long positions).Ī number of long entries are shown on the chart below (back-tests follow later in this article):Ī The E-Mini S&P500 futures contract is trading above a 150-period Simple Moving Average.ī The SMA is colored green, indicating a stable upward trend.Ĭ At point C we can see that price has made a new three day low (its low is the lowest of the last three days). Two Delphic Moving Averages are used, the first as a longer term trend filter, and the second to provide a profit target. If you want to work with daily price charts – a far less stressful and time-intensive style of trading than the rollercoaster ride of intraday scalping – but you aren’t sufficiently capitalised for a portfolio trend-following approach such as the one described later (or simply aren’t comfortable with the longer holding periods associated with trend-following), then a swing trading strategy such as the following may be a great place for you to begin. The following trading strategy has been developed from concepts presented by Larry Connors and Cesar Alvarez in the book ‘Short Term Trading Strategies that Work’. Whatever your timeframe or style, you’re bound to discover ideas here that will help you to make better use of averages in your trading. In the rest of this document we reveal a number of trading strategies that make use of the Delphic Average, we examine performance reports for these setups in a variety of markets, and we discuss the pitfalls and limitations of lagging indicators and the dangers of over-optimisation and curve-fitting in system design. Subtle changes in momentum can provide a great heads up for scalpers.

Switching the ‘PercentChange_On’ from ‘false’ to ‘true’ in the indicator’s inputs tab will cause the percentage change of the Delphic Average to be printed alongside the average (whatever the average type or length), so that you can easily make an informed assessment of the indicator’s movements. The percentage change of a moving average – whether it is increasingly sloping or beginning to flat-line – is a simple but powerful method of measuring a trend’s momentum.

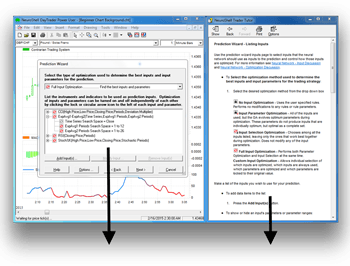

Neuroshell 2 tradestation add on manual#

Like all our products, it comes accompanied with a full user manual detailing examples of trading strategies within which you can employ it. A host of enhanced features include trend definition and rate of change. This versatile TradeStation Moving Average indicator demonstrates the advanced functionality of our products, and is sure to become your go-to tool for all your moving average charting needs. Moving Averages are one of the oldest, simplest, and yet most powerful tools in the technical analyst’s toolkit.

0 kommentar(er)

0 kommentar(er)